CHTR Stock Forecast: A Comprehensive Guide for Investors

Investing in the stock market requires careful research, expert analysis,chtr stock forecast and a forward-thinking approach. One stock that has captured the attention of many investors is Charter Communications Inc. (CHTR). Understanding the CHTR stock forecast can help investors make informed decisions about potential growth, risks, and future performance.

In this article, we’ll explore the CHTR stock forecast in detail. We’ll examine historical performance, expert predictions, market influences, and future outlook. Whether you’re a seasoned investor or just starting, this guide will provide valuable insights to navigate the world of CHTR stock.

What Is CHTR Stock?

CHTR represents Charter Communications Inc., a leading broadband and cable company in the United States. Known for its Spectrum brand, Charter offers internet, TV, and voice services to millions of households and businesses across the country. The company has consistently focused on expanding its broadband services and enhancing customer experience.

Why Investors Are Interested in CHTR Stock

Charter Communications has been a strong player in the telecommunications industry. Here are some reasons why investors are paying close attention to CHTR stock forecast:

- Steady Growth in Broadband Services: Demand for high-speed internet continues to grow.

- Strong Market Position: Charter is one of the largest cable operators in the U.S.

- Innovation and Expansion: The company invests in next-gen technology and network expansion.

- Solid Financial Performance: Consistent revenue growth and profitability attract investors.

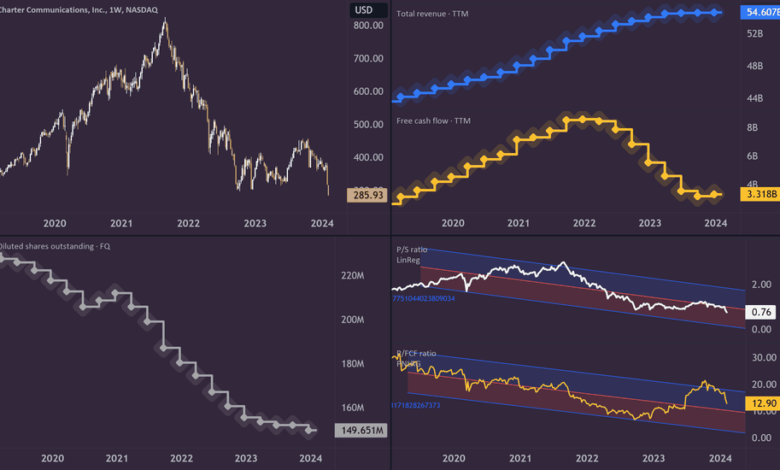

Historical Performance of CHTR Stock

Analyzing historical data is crucial when considering a stock’s future. Let’s take a look at CHTR’s past performance:

| Year | Opening Price | Closing Price | Annual Change (%) |

| 2020 | $480.00 | $660.00 | +37.5 |

| 2021 | $660.00 | $715.00 | +8.3 |

| 2022 | $715.00 | $510.00 | -28.7 |

| 2023 | $510.00 | $590.00 | +15.7 |

Key Takeaway:

- CHTR stock experienced significant growth during the pandemic due to increased internet demand.

- In 2022, macroeconomic challenges led to a decline.

- The rebound in 2023 indicates potential for future growth.

Factors Influencing CHTR Stock Forecast

Several factors impact the CHTR stock forecast. Understanding these elements helps investors anticipate potential movements.

1. Broadband Growth and Market Demand

The increasing reliance on high-speed internet benefits companies like Charter. With more homes adopting smart devices and streaming services, the demand for reliable broadband services is expected to rise.

2. Technological Advancements

Charter continuously invests in next-generation technology. Initiatives like DOCSIS 4.0 aim to deliver faster internet speeds and improved network performance, which can positively influence the CHTR stock forecast.

3. Competitive Landscape

Charter faces competition from fiber-optic providers and wireless carriers. How well the company manages this competition will play a significant role in future stock performance.

4. Economic Conditions

Economic trends like inflation, interest rates, and consumer spending habits can impact stock prices. Charter’s ability to maintain profitability during economic fluctuations will be crucial.

Expert Predictions for CHTR Stock Forecast

Financial analysts have varying predictions about CHTR’s future performance. Let’s summarize some expert insights:

- Optimistic View: Some analysts predict that Charter’s broadband growth and tech innovations will drive significant stock appreciation in the next 3-5 years.

- Neutral Outlook: A few experts caution that increasing competition might slow growth, leading to moderate gains.

- Bearish Perspective: Skeptical analysts highlight potential challenges like market saturation and rising operational costs.

Analyst Forecast Table

| Forecast Period | Predicted Price Range | Analyst Sentiment |

| 2024 | $600 – $650 | Cautiously Optimistic |

| 2025 | $650 – $720 | Positive |

| 2026 | $700 – $780 | Very Positive |

Long-Term Outlook: Where Is CHTR Headed?

The long-term CHTR stock forecast appears promising, given Charter’s strong market presence and continuous innovation. Here’s what investors should consider:

- Expanding Broadband Services: Charter is pushing into rural markets, potentially driving subscriber growth.

- 5G and Wireless Growth: The company’s mobile offerings may become a significant revenue stream.

- Strategic Partnerships: Collaborations with tech giants can enhance Charter’s competitive edge.

Risks to Consider When Analyzing CHTR Stock Forecast

While the outlook is generally positive, potential risks exist:

- Regulatory Changes: New industry regulations could impact operations.

- Competitive Pressures: Fiber-optic companies may capture market share.

- Economic Uncertainty: Recession fears could reduce consumer spending on telecom services.

How to Invest Wisely in CHTR Stock

Investing in CHTR stock requires a balanced approach. Here are some tips for potential investors:

- Conduct Thorough Research: Always review the latest performance reports and forecasts.

- Diversify Investments: Avoid putting all your funds into one stock.

- Monitor Industry Trends: Stay updated on broadband and wireless sector developments.

Final Thoughts: Is CHTR Stock a Good Investment?

The CHTR stock forecast indicates potential for growth, driven by increasing broadband demand, technological advancements, and a solid market position. While challenges like competition and economic fluctuations remain, Charter Communications’ proactive strategies and commitment to innovation present a positive long-term outlook.

As always, investors should conduct their own research and consult with financial advisors when necessary. With careful planning, CHTR stock could be a valuable addition to a well-diversified portfolio.

Stay informed, stay curious, and watch this space for the latest updates on CHTR stock forecast – and remember, great investment decisions often come from well-researched insights.

Published by: GreatUKNews.co.uk